Famous banking companies in Uruguay

Uruguay, a stable and thriving country in South America, is home to a robust financial system with several prominent banking institutions. These banks cater to the needs of individuals, businesses, and foreign investors, reflecting Uruguay’s strong economic policies and high levels of transparency. Below is an overview of some of the most notable banking companies in Uruguay.

1. Banco República (BROU)

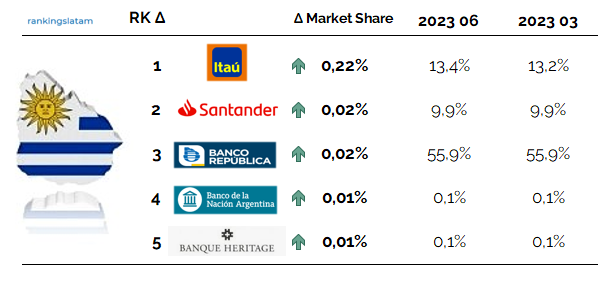

Banco República, also known as BROU, is Uruguay’s largest and oldest state-owned bank, founded in 1896. It is a cornerstone of the country’s financial system, offering a wide range of services, including personal banking, corporate banking, and agricultural financing. BROU has an extensive branch network across Uruguay and a strong focus on supporting local economic growth. Its reputation for reliability and comprehensive financial solutions makes it a leader in the market.

2. Scotiabank Uruguay

Scotiabank, a Canadian multinational bank, has a significant presence in Uruguay. After acquiring the local operations of Nuevo Banco Comercial in 2011, Scotiabank Uruguay expanded its footprint in the country. It offers diverse services such as savings accounts, loans, credit cards, and investment solutions. Known for its customer service and international expertise, Scotiabank attracts clients seeking global financial solutions.

3. Itaú Uruguay

Banco Itaú Uruguay is a subsidiary of the Brazilian financial giant Itaú Unibanco. It operates as one of the leading private banks in Uruguay, focusing on retail and corporate banking services. Itaú Uruguay is renowned for its innovative digital banking solutions, competitive loan rates, and high-quality customer service. Its commitment to technological advancement has made it popular among younger demographics and tech-savvy clients.

4. Santander Uruguay

Santander Uruguay, part of the global Santander Group, is another prominent banking institution in the country. It serves individuals, small businesses, and large corporations with a variety of financial products, including mortgages, savings accounts, and investment options. Santander Uruguay emphasizes digital transformation, offering robust online banking platforms and mobile apps to improve customer experience.

5. HSBC Uruguay

HSBC Uruguay is part of the global HSBC network and specializes in providing international banking services. It caters to both local and international clients, offering corporate banking, trade financing, and wealth management. HSBC is known for its expertise in facilitating cross-border transactions, making it a preferred choice for multinational companies operating in Uruguay.

6. Banco Bandes

Banco Bandes is a Venezuelan-owned bank with a presence in Uruguay since 2006. It focuses on personal banking and business financing. Bandes aims to support local economic development by offering competitive rates and accessible financial products to individuals and small enterprises.

7. Citibank Uruguay

Citibank Uruguay, a branch of the American banking giant Citigroup, primarily serves corporate clients and high-net-worth individuals. Its services include treasury and trade solutions, investment banking, and wealth management. Citibank’s global reach and expertise make it a preferred partner for international businesses in Uruguay.

Conclusion

Uruguay’s banking sector is characterized by a mix of local and international players, each contributing to the country’s economic stability and growth. Banks like Banco República, Scotiabank, and Itaú have established themselves as key pillars of the financial system, while global players like HSBC and Santander offer international expertise. The combination of strong regulation, technological innovation, and customer-focused services ensures that Uruguay’s banking sector remains competitive and resilient in the global financial landscape.

Leave a Reply