Product distribution companies in Uzbekistan

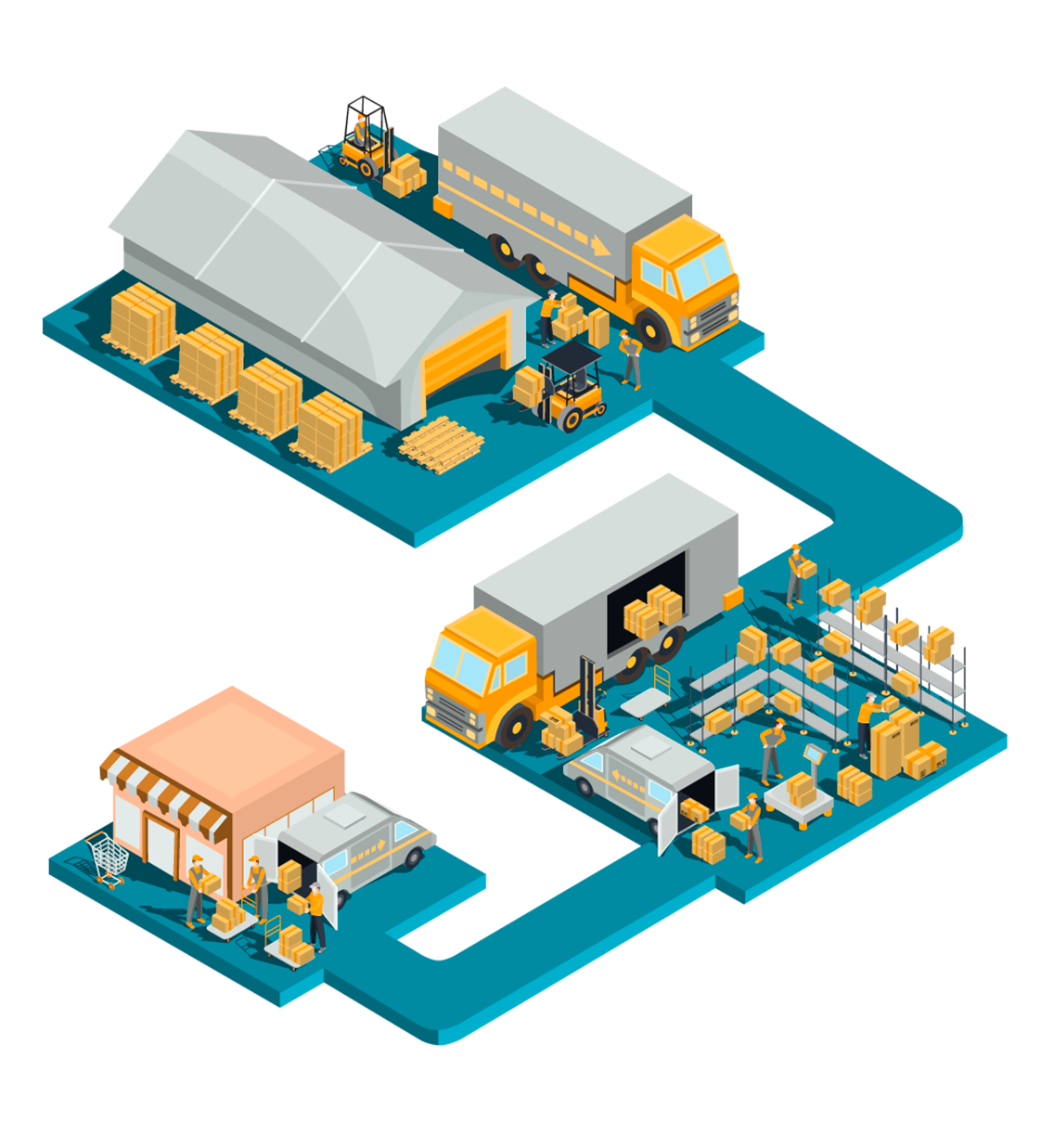

Uzbekistan’s distribution landscape is characterized by a blend of traditional markets and emerging modern retail formats. Independent small grocers dominate the grocery retail sector, accounting for approximately 48% of total retail sales. This prevalence stems from the country’s retail development history, which lacked major investors, leading to a proliferation of independent small operators. Consequently, the distribution of imported consumer goods is primarily conducted through souks and wholesale markets. Exchange rate restrictions have further influenced this dynamic, reducing the number of importers and Western consumer goods imports. Only a few importers with access to foreign currencies have become de facto distributors of certain products. Notably, importer/distributor companies are required to operate at least one shop to obtain foreign currencies.

In recent years, supermarket chains have gained traction in Uzbekistan’s urban centers. Two prominent supermarket chains are:

Anglesey Food: Operating under the “Korzinka.uz” brand, Anglesey Food is a significant local holding company with numerous independent retail outlets. The company focuses on daily consumption products, including fresh fruits and vegetables, packaged food, beverages, semi-ready food products, and home care items.

Beijan Trade: This company owns two of the largest malls in Uzbekistan: “Mega Planet” in Tashkent and “Samarkand Darvoza.” Beijan Trade also operates supermarkets under the “MAKRO” brand, contributing to the modern retail landscape in the country.

Several companies play pivotal roles in product distribution across various sectors in Uzbekistan:

ERC Uzbekistan: Established in 1995, ERC is a leading international distributor with operations in multiple countries, including Uzbekistan. The company specializes in distributing consumer and enterprise computer equipment, household appliances, and home and garden equipment. ERC collaborates with business partners such as national and regional retail networks, independent stores, and project organizations.

Coca-Cola Bottlers Uzbekistan: A joint venture between the Uzbek state and The Coca-Cola Company, established in 1993. Headquartered in Tashkent, the company operates four production facilities across the country. As of 2019, it controlled nearly half of Uzbekistan’s soft drink market, generating significant revenue.

Direct marketing is also prevalent in Uzbekistan, especially among beauty and health product companies. Pioneered by firms like Herbalife, entrepreneurs often utilize social networks to promote products. Other direct marketing methods include distributing free samples at points of sale, cultural events, and door-to-door campaigns. However, marketing by mail is not commonly practiced in the country.

For businesses looking to enter the Uzbek market, due diligence is crucial in selecting appropriate market entry strategies and reliable business partners. Considerations include company solvency, import restrictions and procedures, rule of law issues, and limitations on government investment incentives. Organizations such as the American Chamber of Commerce in Uzbekistan and international audit firms with offices in Tashkent can provide valuable assistance in this regard.

In summary, while traditional distribution channels remain dominant in Uzbekistan, there is a noticeable shift towards modern retail formats. Companies aiming to establish a presence in the Uzbek market should carefully assess the distribution landscape and engage with reputable local partners to navigate the evolving market dynamics effectively.

Leave a Reply