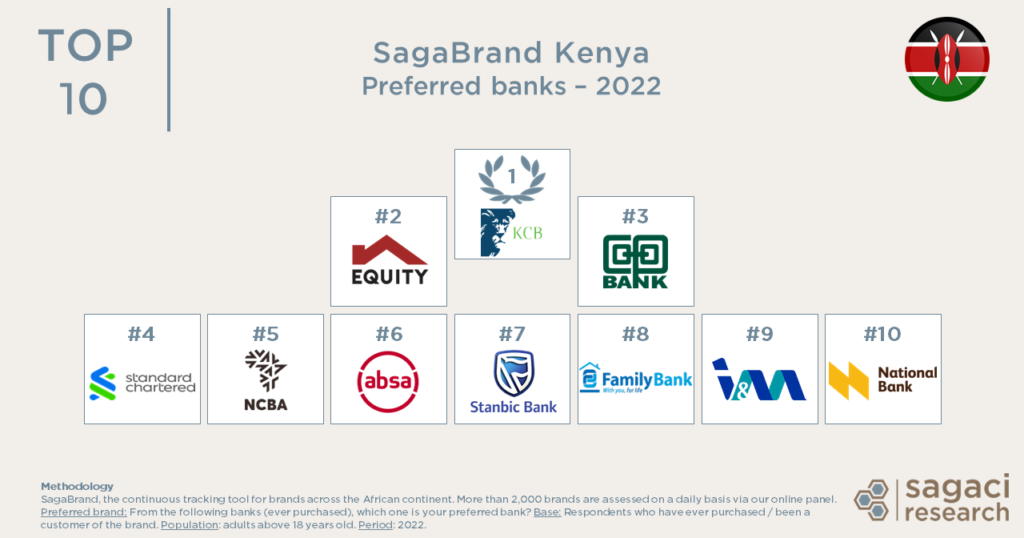

Famous banking companies in Kenya

Kenya has a vibrant banking sector that serves as a cornerstone of the country’s economy. Several banks have established themselves as leaders due to their innovative services, extensive networks, and contributions to financial inclusion. Below are some of the most prominent banking companies in Kenya:

1. Kenya Commercial Bank (KCB) Group

KCB is the largest and most influential bank in Kenya. Established in 1896, it has grown into a regional banking powerhouse with a presence in Uganda, Tanzania, Rwanda, South Sudan, and Burundi. KCB offers a variety of services, including retail banking, corporate banking, and mobile banking through its innovative KCB M-Pesa platform. Known for its customer-centric approach, KCB has played a pivotal role in fostering financial inclusion across East Africa.

2. Equity Bank

Equity Bank is celebrated for its efforts to empower small businesses and low-income customers. Established in 1984, it has transformed from a microfinance institution to one of Kenya’s largest banks. Equity Bank is well-known for its digital banking solutions, such as Equity Mobile, and its social impact programs. The bank’s extensive branch and agent network ensures accessibility even in remote areas, making it a champion of financial inclusion.

3. Co-operative Bank of Kenya

The Co-operative Bank is a unique financial institution founded in 1965 to serve Kenya’s cooperative movement. It has since expanded its services to cater to a broader audience while maintaining its roots in supporting cooperatives. The bank offers retail, corporate, and SME banking services, with innovative products like MCo-op Cash. Its commitment to empowering cooperatives and small businesses has cemented its reputation as a customer-friendly institution.

4. Standard Chartered Bank Kenya

Standard Chartered is one of Kenya’s oldest banks, having operated in the country since 1911. A subsidiary of Standard Chartered PLC, the bank specializes in serving corporate and high-net-worth individuals. It is known for its advanced digital banking platforms and innovative products, such as SC Mobile Kenya, which allows customers to perform a wide range of transactions online. The bank has earned a reputation for excellence in wealth management and trade finance.

5. Absa Bank Kenya

Previously known as Barclays Bank Kenya, Absa rebranded in 2020 to align with its parent company, Absa Group Limited. The bank has a long history in Kenya, dating back to 1916. Absa offers comprehensive banking solutions, including retail, corporate, and investment banking. Its commitment to technological innovation is evident in products like Timiza, a mobile app that provides quick loans and other financial services.

6. NCBA Bank

NCBA Bank is the result of a merger between NIC Bank and Commercial Bank of Africa (CBA) in 2019. Known for its innovative products, NCBA is a market leader in digital banking, thanks to the success of M-Shwari, a mobile-based savings and loans product developed in partnership with Safaricom. The bank focuses on retail, corporate, and asset financing services.

7. Family Bank

Family Bank is a mid-tier bank with a strong focus on small and medium-sized enterprises (SMEs) and retail customers. The bank has positioned itself as a reliable partner for businesses and individuals, offering products like PesaPap, a mobile banking app. Family Bank has been instrumental in promoting financial literacy and empowering small-scale entrepreneurs.

Conclusion

Kenya’s banking sector is characterized by a mix of local and international banks that provide a wide range of financial services. Institutions like KCB, Equity Bank, and Co-operative Bank have pioneered efforts to promote financial inclusion, while global players like Standard Chartered and Absa bring international expertise. These banks not only drive economic growth but also foster innovation and accessibility, ensuring that banking services reach every corner of the country.

Leave a Reply