Famous banking companies in Ukraine

Ukraine’s banking sector is diverse, with a mix of state-owned, private, and foreign banks that play a vital role in the country’s economy. Here are some of the most notable banking companies in Ukraine:

1. PrivatBank

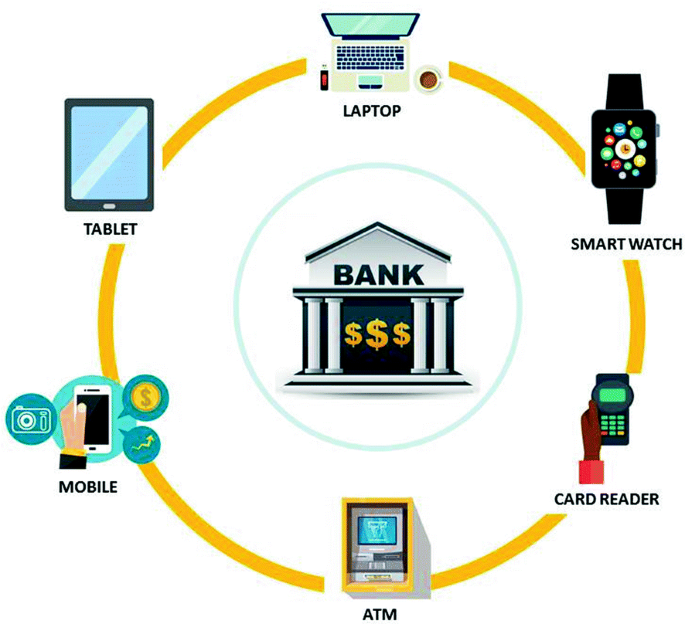

PrivatBank is the largest and most well-known bank in Ukraine. Founded in 1992, it is state-owned and serves millions of customers. The bank is recognized for its innovative digital banking solutions, including the popular “Privat24” online banking platform. PrivatBank specializes in retail banking, corporate banking, and investment services, making it a cornerstone of Ukraine’s financial landscape.

2. Oschadbank

Oschadbank, also known as the State Savings Bank of Ukraine, is another significant state-owned institution. Established in 1991, it focuses on providing financial services to individuals, businesses, and government entities. Oschadbank is renowned for its extensive branch network and commitment to economic development in rural and urban areas.

3. Raiffeisen Bank Ukraine

Raiffeisen Bank Ukraine is a subsidiary of Raiffeisen Bank International, an Austrian banking group. It is one of the leading foreign banks in Ukraine, offering a wide range of financial products, including loans, deposits, and wealth management services. The bank is particularly popular among corporate clients and small to medium-sized enterprises (SMEs).

4. Ukrsibbank (BNP Paribas Group)

Ukrsibbank is part of the French BNP Paribas Group and is one of the top foreign-owned banks in Ukraine. Known for its high standards of customer service, Ukrsibbank offers personal and business banking solutions. Its affiliation with BNP Paribas allows it to provide international financial services to its clients.

5. Alfa-Bank Ukraine (Now Sense Bank)

Previously known as Alfa-Bank Ukraine, Sense Bank is a private financial institution offering a full spectrum of banking services. It is known for its modern approach to banking, including advanced mobile banking solutions. The bank serves retail and corporate clients, emphasizing technological innovation.

6. Ukreximbank

Ukreximbank, or the Export-Import Bank of Ukraine, is a state-owned financial institution focused on supporting export and import activities. It plays a crucial role in facilitating international trade and providing financing to Ukrainian businesses engaged in global markets. The bank is instrumental in fostering Ukraine’s economic integration with the world.

7. Credit Agricole Ukraine

A subsidiary of the French banking giant Credit Agricole Group, this bank is known for its expertise in agribusiness and corporate banking. It also offers retail banking services, including savings accounts, loans, and investment options. Credit Agricole Ukraine has built a strong reputation for supporting the agricultural sector.

8. PUMB (First Ukrainian International Bank)

PUMB is one of Ukraine’s largest private banks, focusing on retail and corporate banking. Founded in 1991, the bank has developed a strong customer base and is known for its reliability and efficient banking services. PUMB offers a wide range of products, from credit cards to business loans.

9. Taskombank

Taskombank is a privately owned bank with a strong focus on corporate banking and retail services. It offers a range of financial products, including deposits, loans, and payment cards. Taskombank is recognized for its customer-centric approach and robust financial stability.

10. KredoBank

KredoBank is a subsidiary of Poland’s PKO Bank Polski, making it one of the few banks in Ukraine with a Polish connection. It specializes in providing banking services to small and medium enterprises (SMEs), as well as individuals. Its international ties have helped enhance its credibility and offerings.

Conclusion

Ukraine’s banking sector reflects a mix of state-owned giants, private institutions, and international players, each contributing uniquely to the country’s financial stability and economic growth. With ongoing reforms and technological advancements, these banks continue to adapt to modern financial challenges while supporting the nation’s development.

Leave a Reply